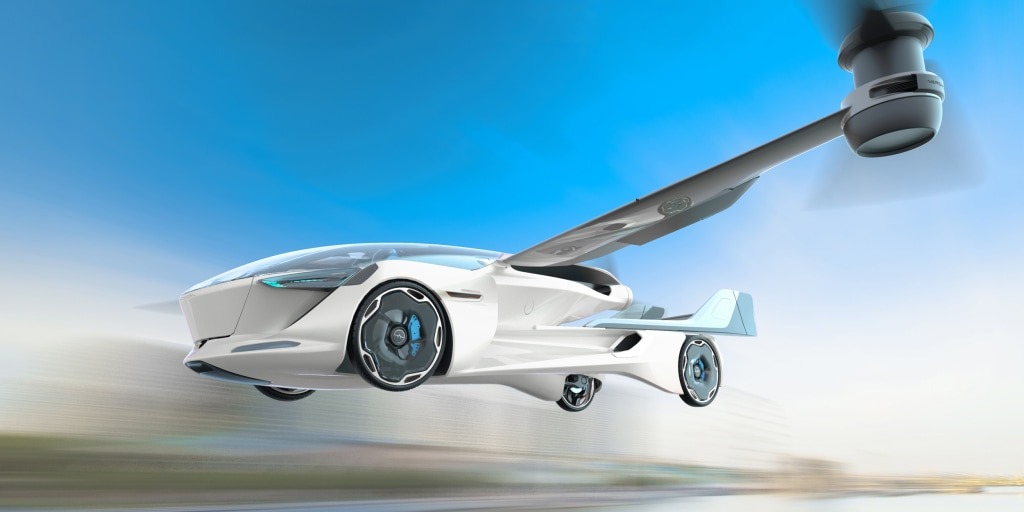

Introduction: The Dawn of a New Transportation Era

The transportation zone stands on the brink of its maximum radical transformation since the invention of the auto. Flying vehicles—once constrained to the realm of science fiction—are actually a tangible reality, with prototypes already present, process check flights and main agencies making an investment of billions. For forward-wondering traders, this emerging sector provides a unique opportunity to take part in what could end up a $1.Five trillion market through 2040 (Morgan Stanley estimate).

But is this technology actually possible? Which corporations are leading the price? And in which must savvy investors focus their attention?

Why Flying Cars Are Inevitable

1. Solving the Urban Mobility Crisis

Global cities are choking on congestion:

- Los Angeles commuters waste 102 hours per year in traffic (INRIX)

- Mumbai’s average traffic speed is just 12.4 km/h (TomTom Traffic Index)

- London’s congestion costs the economy £5.1 billion annually (Transport for London)

Flying cars (eVTOLs—electric vertical takeoff and landing vehicles) promise to:

- Reduce a 90-minute ground commute to 15 minutes

- Operate from vertiports requiring 1/10th the space of traditional infrastructure

- Serve as air taxis, emergency responders, and cargo carriers

2. The Green Transportation Mandate

With governments pushing for net-zero emissions, eVTOLs offer:

- Zero direct emissions (electric models)

- 75% quieter than helicopters (NASA research)

- 4x more energy-efficient than traditional aircraft (Archer Aviation)

The EU’s “Smart Cities Mobility Initiative” has already allocated €1.2 billion for urban air mobility projects.

3. Technological Perfect Storm

Key breakthroughs enabling flying cars:

- Solid-state batteries (QuantumScape, 2025 rollout) doubling energy density

- Autonomous flight systems (Wisk Aero’s 6th-gen AI pilot)

- Advanced air traffic control (NASA’s UTM project for drone integration)

Investment Opportunities: Where to Place Your Bets

1. Pure-Play eVTOL Companies (High Risk/High Reward)

| Company | Key Advantage | Recent Milestone | Market Cap (Aug 2023) |

| Joby Aviation (JOBY) | Toyota manufacturing partnership | FAA certification expected 2024 | $3.2B |

| Archer Aviation (ACHR) | United Airlines $1B order | Midnight model flight tests | $1.8B |

| EHang (EH) | First commercial operations in China | 3,000+ test flights completed | $900M |

2. Aerospace & Auto Giants (Lower Risk Plays)

- Hyundai (005380:KS): $500M investment in Supernal, targeting 2028 launch

- Toyota (TM): Manufacturing expertise for Joby’s production ramp

- Boeing (BA): Wisk Aero autonomous eVTOLs (2028 service entry)

3. Infrastructure & Enabling Technologies

- Vertiports: Ferrovial building 10 UK sites by 2025

- Batteries: Solid Power (SLDP) solid-state tech for longer range

- Air Traffic AI: ANRA’s smart skyway management system

Critical Risks Investors Must Consider

1. Regulatory Hurdles

- FAA certification timeline slippage (Joby’s initial 2023 target pushed to 2024)

- Local zoning battles over vertiport locations (See NYC’s drone port rejections)

2. Economic Viability Challenges

- Current cost per flight:

- 200−300∗∗(vs.target∗∗

- 200−300∗∗(vs.target of∗∗50-100 for mass adoption)

- Limited battery life: Most prototypes max out at 100 miles/charge

3. Public Acceptance

- 42% of urban residents express safety concerns (McKinsey 2023 survey)

- Noise complaints despite being quieter than helicopters

Investment Timeline & Strategy

2024-2026 (Speculative Phase)

- Focus on liquidity and volatility management

- Watch for FAA/EASA certification wins

- Potential IPO targets: Lilium, Vertical Aerospace

2027-2030 (Growth Phase)

- Shift to revenue-generating operators

- Vertiport REITs may emerge as stable plays

- Battery tech breakthroughs could reshape the field

2030+ (Maturity Phase)

- Look for consolidation and profitability

- Urban air mobility could become 20% of intra-city transport

Conclusion: Navigating the Flight Path to Profit

The flying car revolution isn’t a matter of if, but when. Early investors should:

- Allocate wisely (3-5% of high-risk portfolio)

- Diversify across vehicle makers, infrastructure, and tech

- Monitor regulatory milestones like hawk

As Boeing CEO Dave Calhoun recently stated: “The first trillion-dollar aerospace company will be an eVTOL developer.” Will your portfolio be along for the ride?

Want deeper analysis on any segment? I can provide:

- Detailed company financial comparisons

- Regulatory timeline projections

- Technical deep dives on battery/autonomy tech